Why Equifax Experian And Transunion Have Different Scores

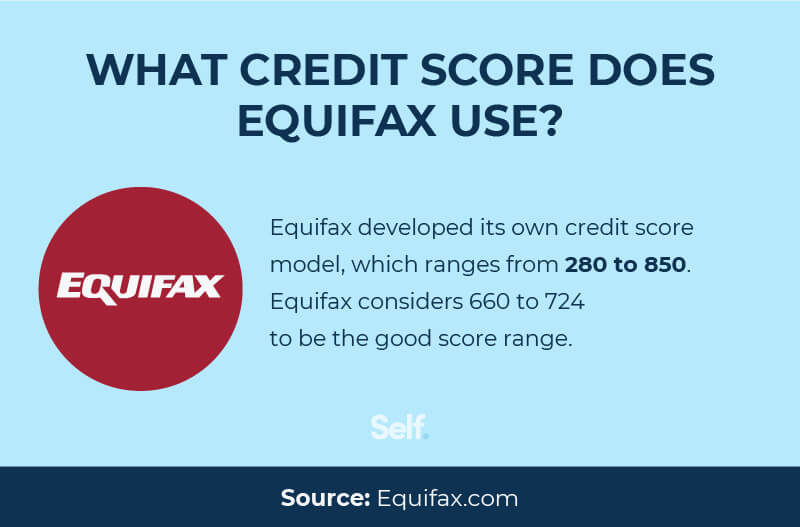

Transunion Vs Equifax Major Differences Explained Self Credit Builder This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. these factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureaus—which is also unusual. While there’s no exact answer to which credit score matters most, lenders have a clear favorite: fico® scores are used in over 90% of lending decisions. while that can help you narrow down.

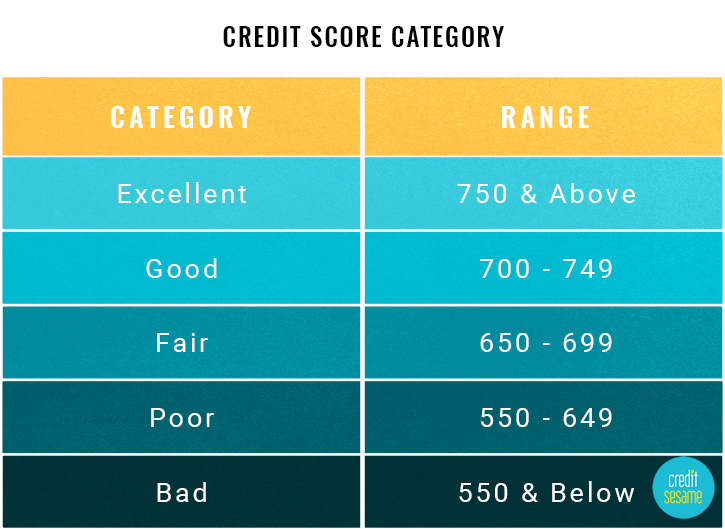

Why Equifax Experian And Transunion Have Different Scores The Your credit score is made up based on five different criteria: payment history makes up 35% of your score. credit utilization (amounts owed) is 30%. this is the amount you owe on your credit cards. So, it’s possible that equifax and transunion could have different credit information on your reports, which could lead to your transunion score differing from your equifax score. you may be seeing scores from different dates. a credit score is a snapshot of your credit profile at a specific point in time. since credit scores can change over. Scores are from different dates. since your scores might change at any time, it’s important to compare credit scores from the same date. we recommend you periodically check your credit reports for errors, which could affect your scores. you can check your equifax and transunion credit reports for free on credit karma, and your experian report. Prevent unauthorized access to your credit files. if there is any suspicious activity on any of your 3 credit reports, you can add a fraud alert at experian, which is also shared with equifax and transunion. ø results will vary. not all payments are boost eligible.

Credit Score Chart Business Mentor Scores are from different dates. since your scores might change at any time, it’s important to compare credit scores from the same date. we recommend you periodically check your credit reports for errors, which could affect your scores. you can check your equifax and transunion credit reports for free on credit karma, and your experian report. Prevent unauthorized access to your credit files. if there is any suspicious activity on any of your 3 credit reports, you can add a fraud alert at experian, which is also shared with equifax and transunion. ø results will vary. not all payments are boost eligible. Transunion credit monitoring. the transunion credit agency offers a one size fits all approach to credit monitoring that will cost you $29.95 a month. this service offers multiple benefits to keep your credit score intact: unlimited credit score updates. email updates of important changes to your credit history. Why are my fico ® scores different for the 3 credit bureaus? in the u.s., there are three national credit bureaus (equifax, experian and transunion) that compete to capture, update and store credit histories on most u.s. consumers. while most of the information collected on consumers by the three credit bureaus is similar, there are differences.

Comments are closed.