Why Im Able To Track Every Expense For The Past 6 Years How To Track Expenses

Why I M Able To Track Every Expense For The Past 6 о Hey all! i break down exactly how i've tracked and manage my expenses for the past 6 years. i haven't missed a single one and knowing this has helped me a. 3 steps to track expenses. if you’re ready to become a champion spending tracker, there are three steps you need to take. first, create a budget. then, decide how you will track your spending (with an app, spreadsheet, etc.) lastly, schedule weekly check ins to keep yourself on track. 1.

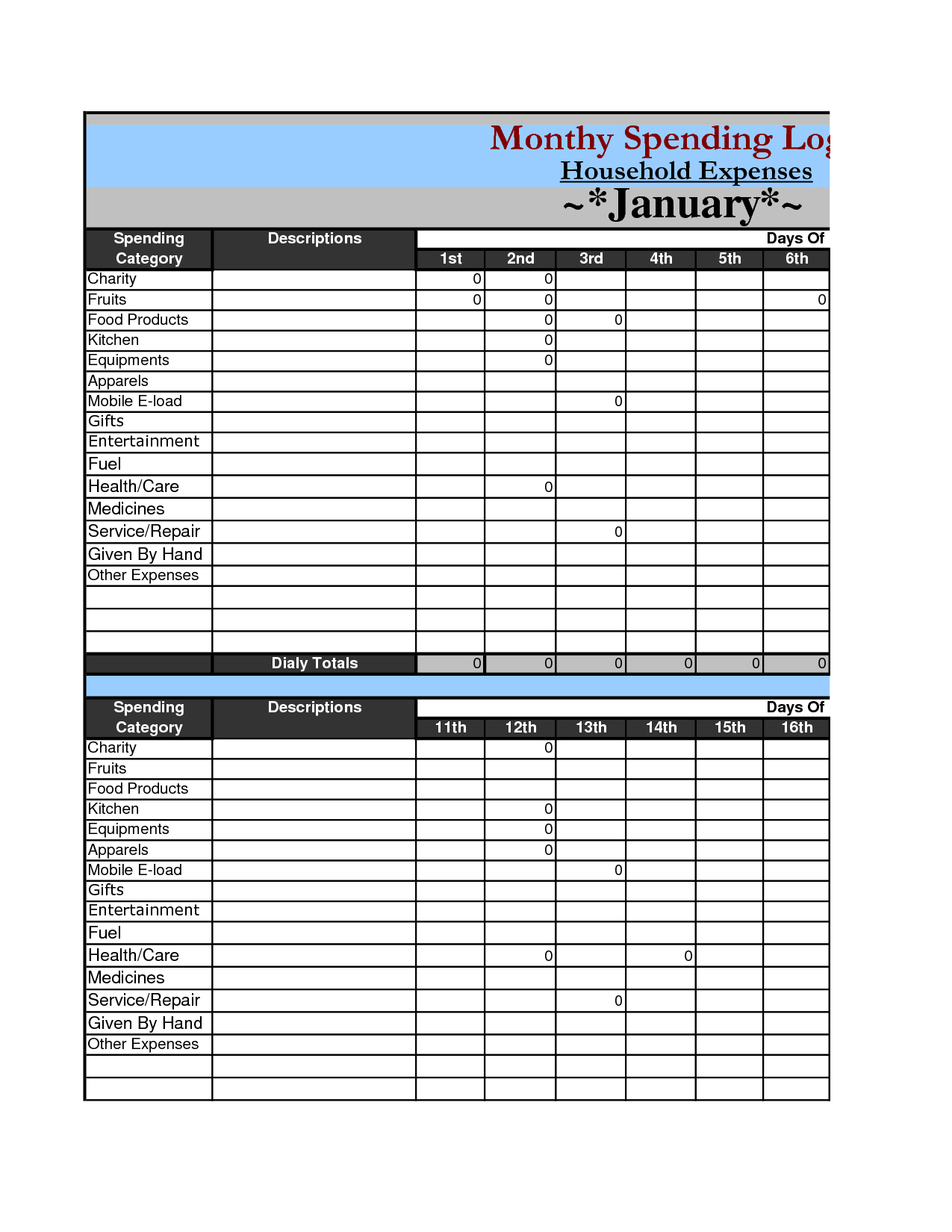

Excel Income And Expense Tracker Trustplm How to track expenses in four simple steps. Use an even older method – receipt tracking: if you prefer offline methods of tracking your expenses, then keep hold of your receipts and manually input your expenses at the end of each day or week – maybe write them down in a notebook. this offers a tangible, visual way of keeping tabs on your money. regularly review your budget: review. 6 reasons why you should track your expenses. meticulous expense tracking can bring along a wide range of benefits. if you are a small business owner, tracking your expenditures (office supplies, utilities, salaries, subscriptions, mileage, etc.) helps you run your business smoothly and efficiently. the same goes for individuals. Categorize your spending. with your basic budget in hand, you are ready to take the next step in expense tracking by categorizing your expenses. this will give you a much clearer view of where your money is actually going each month, and make it easier for you to make revisions to your budget as needed.

Monthly Expense Tracking The First Step To Financial Success World 6 reasons why you should track your expenses. meticulous expense tracking can bring along a wide range of benefits. if you are a small business owner, tracking your expenditures (office supplies, utilities, salaries, subscriptions, mileage, etc.) helps you run your business smoothly and efficiently. the same goes for individuals. Categorize your spending. with your basic budget in hand, you are ready to take the next step in expense tracking by categorizing your expenses. this will give you a much clearer view of where your money is actually going each month, and make it easier for you to make revisions to your budget as needed. This way, you can see if your budget is enough or not for each expense bucket. keep on adjusting the amount you spend as needed so you can eventually learn how to stick to a budget. 6. wisely allocate the money you didn’t use. if you have some money left from your budget, think of other ways to make use of that money. Here are a few ideas for building a better system for tracking expenses to help get you started. 1. create a business bank account; 2. stay on top of your receipts; 3. take special note of all business travel; 4. note your expenses as they occur; 5. use software to track and analyze business purchases; 6. hire a bookkeeper; track expenses the.

Free Printable Expense Tracker 7 Easy Tools To Track Your Spending This way, you can see if your budget is enough or not for each expense bucket. keep on adjusting the amount you spend as needed so you can eventually learn how to stick to a budget. 6. wisely allocate the money you didn’t use. if you have some money left from your budget, think of other ways to make use of that money. Here are a few ideas for building a better system for tracking expenses to help get you started. 1. create a business bank account; 2. stay on top of your receipts; 3. take special note of all business travel; 4. note your expenses as they occur; 5. use software to track and analyze business purchases; 6. hire a bookkeeper; track expenses the.

Comments are closed.