Why Is Open Banking Important Benefits Of Open Banking Youtube

:max_bytes(150000):strip_icc()/open_banking-final-8af075f74bb54196bbbd342f717e7716.jpg)

Open Banking Definition How It Works And Risks A brief overview of the essential elements and benefits of open banking. In europe, thanks to psd2 regulations, all banks must provide an api to give users access to their banking data. developers can build third party apps using.

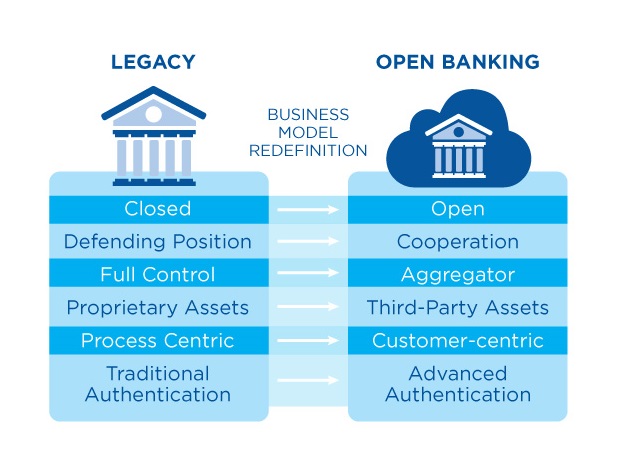

Open Banking Explained How It Works And Why It Matters One of the major reasons why open banking is seen as a catalyst by many governments and markets, is that it will boost growth and increase economic efficiency. one report from mckinsey estimates that the adoption of open banking could result in “1 to 1.5 percent of gdp in 2030 in the european union, the united kingdom, and the united states, to as much as 4 to 5 percent in india.”. Below, you’ll find some important benefits of open banking for the everyday user. these showcase what is already available to consumers, as well as some of the possibilities for the future. control over your financial data. open banking legislation was created with the aim of giving customers an absolute control over their financial information. The benefits of open banking for bank customers. for customers, open banking is a significant opportunity to bring more of the innovations they enjoy in other areas of their lives to their banking services through new and better processes, products and services. among the possibilities created by open banking is the ability to see a fuller. Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition.

Open Banking How Does It Work Benefits Challenges The benefits of open banking for bank customers. for customers, open banking is a significant opportunity to bring more of the innovations they enjoy in other areas of their lives to their banking services through new and better processes, products and services. among the possibilities created by open banking is the ability to see a fuller. Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition. Open banking is still in the early adoption phase for much of the industry. but it has huge potential for wealth management professionals to offer more personalized services, create new business models and generate revenue. we have two experienced speakers who will lead this webinar today, raghid nami and erion karroqe. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation.

Open Banking Another Round Of Fintech Vilmate Open banking is still in the early adoption phase for much of the industry. but it has huge potential for wealth management professionals to offer more personalized services, create new business models and generate revenue. we have two experienced speakers who will lead this webinar today, raghid nami and erion karroqe. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation.

Comments are closed.