Why Roth Investments Are Better Than Traditional

Traditional Vs Roth Ira Yolo Federal Credit Union The main difference between a roth ira and a traditional ira is how and when you get a tax break. contributions to traditional iras are tax deductible, but withdrawals in retirement are taxable as. The key difference between roth and traditional individual retirement accounts (iras) lies in the timing of their tax advantages. with traditional iras, you deduct contributions now and pay taxes.

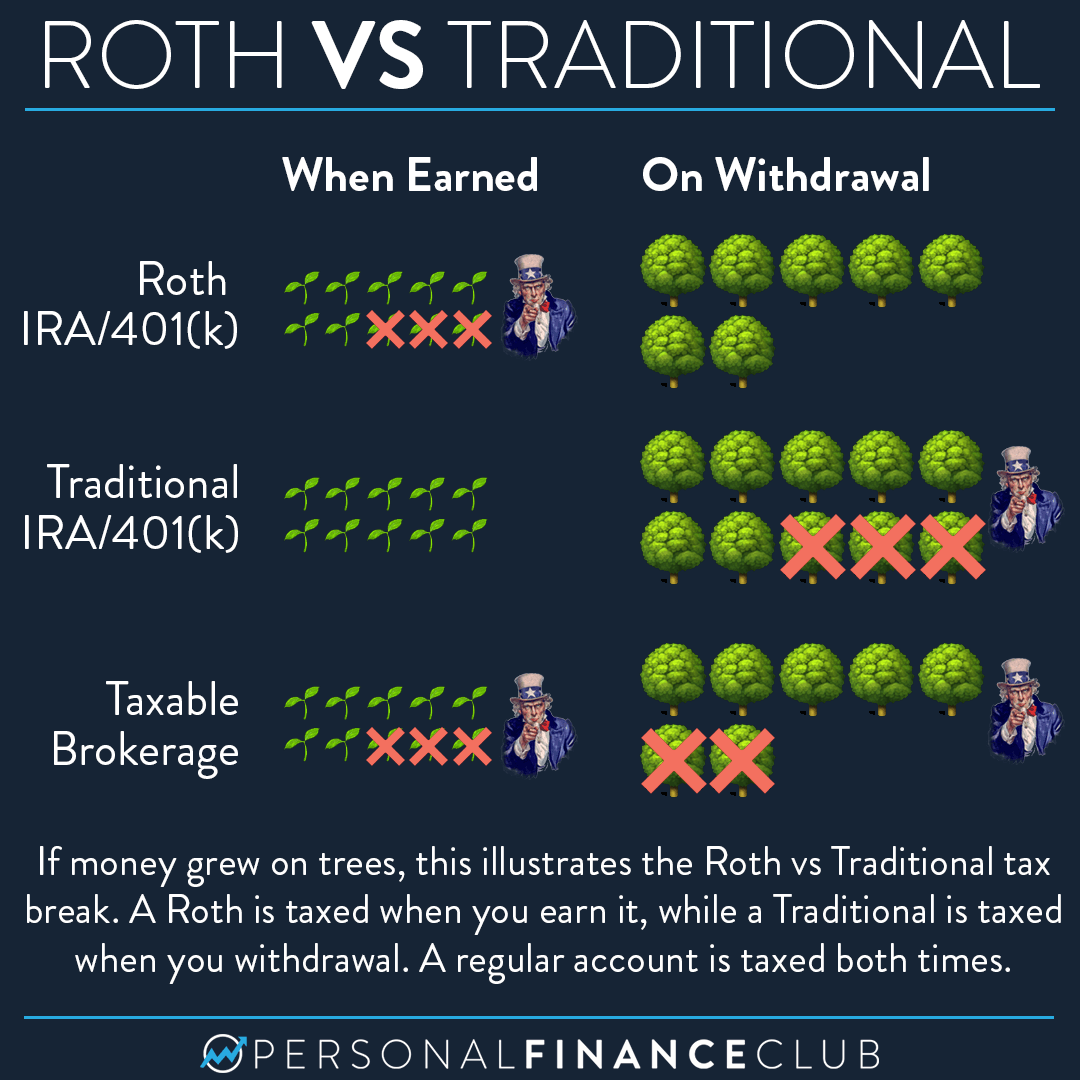

Roth Vs Traditionalвђ How Do The Taxes Work вђ Personal Finance Club Traditional ira contributions are made with pre tax dollars, while roth ira contributions are made with after tax dollars. investment gains in a traditional ira are tax deferred, so you’re paying taxes eventually. gains in a roth ira are completely tax free. traditional ira withdrawals are subject to taxes, while roth ira withdrawals are tax. But the traditional ira would also have a tax liability of about $184,000 (40% of $461,000), thus giving the roth that impressive $184,000 edge. tilting the playing field. this analysis gets to that huge advantage by tilting the playing field in the roth ira's favor in two ways. one is that lofty tax rate, which takes such a big bite out of the. The key distinctions between roth iras and traditional iras involve two main considerations: taxes and timing. traditional iras offer the potential for tax deductibility in the present, while roth. There are no penalties on withdrawals of roth ira contributions. but there's a 10% federal penalty tax on withdrawals of earnings. exceptions to the penalty tax. with a traditional ira, there's a 10% federal penalty tax on withdrawals of both contributions and earnings. exceptions to the penalty tax.

Comments are closed.