Why You Need A Fact Sheet For Each Of Your Nonprofits Programs

The юааwhyюаб And How Of The юааnonprofitюаб юааfactюаб юааsheetюаб тлж Choose To Improve Fact sheets are essential, inexpensive, nonprofit marketing tools that provide a short, concise, typically one page, educational summary of relevant information. they usually fulfill one or more the following purposes: identifying your organization with a particular issue; communicating key facts related to your organization;. A media kit (sometimes referred to as a press kit) may be hard or soft copy. many nonprofit organizations fail to have a media kit due to lack of staff, lack of awareness as to the importance of one, or even the belief that one is not needed. not having a media kit is one of the biggest mistakes a nonprofit can make. media kits are an essential.

15 Nonprofit Infographics To Boost Campaigns Venngage Report Making information easy to find is the key to a successful media kit. it doesn’t need to be a big project– keep things simple and easy to read. avoid including too much or irrelevant information and put your most important information up front. the easier it is for a journalist to find the facts, the more likely they will use them in a story. The 4 financial statements nonprofits must keep. 1. statement of financial position. the first and most desired financial statement is the statement of financial position. nonprofits use this statement to share what their organization owns and what it owes. the idea is to give an overall picture of the nonprofit at a specific time. Community foundation of northwest florida, one of our nonprofit users, sets the perfect example for you. 5. write text. in addition to the numbers, design, and pictures, you’ll need to write descriptive text to go in your annual report. this is where you can provide qualitative data. The u.s. department of labor recently issued update fact sheet #71, clarifying that the key test for whether unpaid interns are owed overtime and minimum wage under the federal labor standards act is the “primary beneficiary” determination – i.e., whether the worker or the business benefits more. by its own terms, fact sheet #71 continues.

Infographic Nonprofits On Benefits 2019 Report Community foundation of northwest florida, one of our nonprofit users, sets the perfect example for you. 5. write text. in addition to the numbers, design, and pictures, you’ll need to write descriptive text to go in your annual report. this is where you can provide qualitative data. The u.s. department of labor recently issued update fact sheet #71, clarifying that the key test for whether unpaid interns are owed overtime and minimum wage under the federal labor standards act is the “primary beneficiary” determination – i.e., whether the worker or the business benefits more. by its own terms, fact sheet #71 continues. Planned giving refers to the process of donors committing to give planned gifts to nonprofit organizations. planned gifts are charitable contributions that are part of a donor’s financial or estate plans and are typically given to nonprofits once the donor passes away. it's also often called legacy giving, although this term typically refers. How to write a successful fundraising plan. 1. reflect on your past finances. before you start putting together a fundraising plan for the upcoming year, it’s best to look at last year’s finances. at minimum, take a note of your total revenue and expenses.

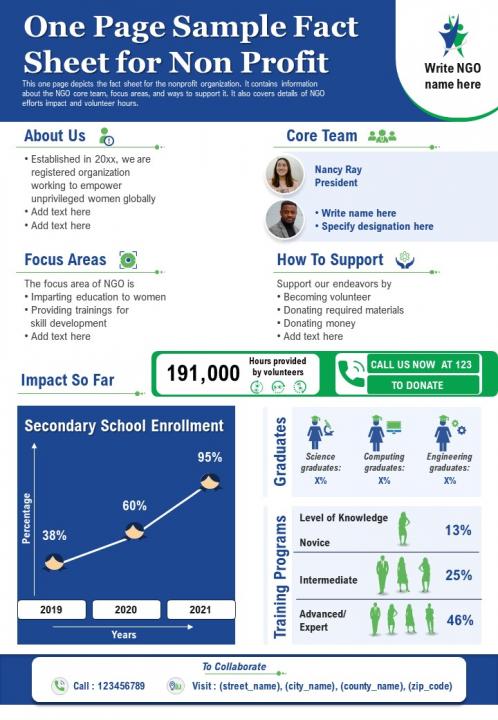

One Page Sample Fact Sheet For Non Profit Presentation Report Planned giving refers to the process of donors committing to give planned gifts to nonprofit organizations. planned gifts are charitable contributions that are part of a donor’s financial or estate plans and are typically given to nonprofits once the donor passes away. it's also often called legacy giving, although this term typically refers. How to write a successful fundraising plan. 1. reflect on your past finances. before you start putting together a fundraising plan for the upcoming year, it’s best to look at last year’s finances. at minimum, take a note of your total revenue and expenses.

Comments are closed.